GLD – How Do I (Not) Love Thee? Let Me Count the Ways!

Are you still weighing your options – considering whether to invest in physical gold and silver or take the “easy” way out by investing in an exchange traded fund? I really hate to hear that. Let’s see if I can help you.

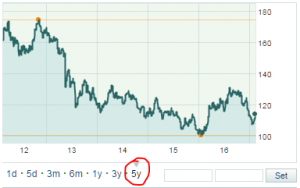

SPDR Gold Trust – Price 2012-2017

First, let’s be sure we all know the creature we will be discussing in this article. We are examining SPDR© Gold Shares, which is an exchange traded fund (ETF) that trades under the symbol GLD.

There is an illusion promulgated that when you buy GLD, you become an owner of the gold which is owned by GLD. However, if you read its literature carefully, you quickly learn that is not true.

Even on the home page of the SPDR® Gold Trust, where the company describes the product, you find this language:

“SPDR® Gold Shares are intended to offer investors a means of participating in the gold bullion market without the necessity of taking physical delivery of gold, and to buy and sell that interest through the trading of a security on a regulated stock exchange.”

When you buy GLD, you are not buying gold. You are “participating” in the gold bullion market by buying a “security” (paper). I have expounded on the significance of this in another article, so I won’t regurgitate it here, but if you haven’t read my article entitled Physical Gold IRA vs. Gold ETF, I encourage you to do so – especially if you are considering investing in GLD, or any other ETF for that matter. You will find it enlightening.

Assuming you have now familiarized yourself with the background information about GLD provided in the just-referenced article, let me expound on yet another reason why I consider GLD a “no go.”

GLD Is a Grantor Trust!

Now, I know that probably doesn’t mean a thing to you at this point. I, on the other hand, prepare tax returns and I am painfully aware of the significance of a grantor trust in terms of the complications that can result to an unsuspecting taxpayer who owns an interest in one.

A grantor trust under United States tax law is a trust which is not subject to U. S. federal income tax. Sounds great so far, right? Keep reading.

The grantor trust is not subject to federal income tax, but guess who is – YOU! That’s right. The trust’s income and expenses “flow through” the trust to shareholders like you each year.

So, if you become a shareholder in GLD, each year you will be treated as if you directly received your pro rata share of the trust’s income, and also of the proceeds of any sales of capital assets (think gold). You will also be treated as if you directly incurred your pro rata share of the trust’s expenses.

There is one other wrinkle. I say you will be treated “as if” you received the income and proceeds, and incurred the expenses, because you won’t actually receive or incur them. You’re just going to be taxed as if you did. The trust isn’t going to distribute anything to you.

Now, since SPDR® Gold Trust only holds gold bullion as an asset, it normally doesn’t receive any “income” in a given year. But, it does have to sell some of that gold from time to time to pay the expenses of maintaining the trust. (By the way, that’s another reason I don’t like GLD. I explain that too in my other article.)

Here’s where it gets really interesting. Because GLD normally only sells a relatively small amount of gold each year for the payment of the trust’s expenses and because it usually makes no distributions of the sale proceeds to its shareholders, under IRS regulations neither the trust not the brokers who sell you the shares are required to send you a 1099-B at the end of the year. How convenient (for them).

The 1099-B is the IRS form upon which brokers are normally required to report to you (and the IRS) the information you must include on your income tax return as a result of the sale of capital assets. Armed with a 1099, it is usually fairly easy to transcribe the information onto your own personal income tax returns.

On the other hand, if you don’t receive a 1099, it’s a very different story. It would take me pages and pages to try to explain to you what you are required to do as a shareholder of GLD when reporting your share of GLD’s transactions on your personal tax return. And, you would either be asleep by the time I was finished, or perhaps have left this website altogether, never to return. I don’t wish to drive you away.

Fortunately, there is an easier way for me to get my point across. GLD has done the heavy lifting for us. Just click the link and it will take you to GLD’s very own “SPDR® Gold Trust 2012 Grantor Trust Tax Reporting Statement.” No, really. Do it. Come on – humor me.

You don’t have to read the whole cursed thing. Just scan through it quickly, especially the examples about how to calculate your pro rata share of expenses and proceeds. I promise – you’ll quickly get my point about the joy of being a shareholder in a grantor trust like SPDR® Gold Trust.

Summary

If you were still entertaining the possibility of investing in a gold or silver ETF (like SPDR® Gold Trust) even after reading my other article, because you still believed that it would somehow be “easier” or “more convenient,” then I hope this article helped you eliminate that “irrational exuberance” for ETFs like GLD. I know that is the case if you followed my encouragement to look at GLD’s own Tax Reporting Statement.